Literacy refers to our ability to understand and learn from what we read; think critically about what has been written and clearly communicate ideas through the written word. Literacy is the backbone of all of our learning, and helps us to participate fully in our communities, the workforce and the larger society.

An examination of national literacy statistics reveals a very sobering reality. There was no significant change in adult literacy rates between 1992 and 2003 (Institute for Education and Sciences). The United States ranks number 12 of 20 high income countries in literacy. Forty-four million adults in the U.S. can’t read well enough to read a simple story to a child. Over one million children drop out of school each year, costing the nation over $240 billion in lost earnings, forgone tax revenues, and expenditures for social services. (U.S. Department of Education)

On the income side, assuming a 45 year career, high school graduates can expect on average, to earn $1.2 million; those with a bachelor’s degree, $2.1million; and people with a master’s degree, $2.5 million. People with doctoral degrees earn an average of $3.4 million during their working lives, while those with professional degrees do best at $4.4 million. The average annual salary for high school dropouts in 1999 was $18,000, or $810,000 in a lifetime. (Robert Longley).

Sixty percent of America’s prison inmates are illiterate and 85% of all juvenile offenders have reading problems. Approximately 50% of the nation’s unemployed youth age 16-21 are functional illiterate, with virtually no prospects of obtaining good jobs. (Department of Education)

Drilling down to the community level, US Census data reveals that approximately 42% of North Lawndale families live in poverty, and the median income for the community was $18,342 in 2008. This is comparable to income levels of people who have dropped out of school. Given the relationship between poverty, education and crime, it comes as no surprise that many of North Lawndale’s schools are among the City’s lowest performing in terms of basic reading, math and science. Approximately 30% of students attending local neighborhood schools either dropped out or left CPS by the time they reached 19 in 2016, compared to the city wide average drop out rate of 22%. (CPS). Our community has one of the highest crime rates in the City. Indeed, North Lawndale is one of the top 6 communities to which ex-offenders return from state prisons. We are also one of a handful of communities that sends a steady stream of detainees to the Cook County Juvenile Temporary Detention Center.

Unless we make drastic improvements, our low literacy rates will continue to be a major barrier to developing the community to its fullest potential. As it stands, many employers are not willing to locate their businesses in North Lawndale because they are concerned about high crime rates and the low education and skill levels of community residents. It will take a village to make the necessary changes, but it can be done with all hands on deck. Here are a few suggestions:

1. Read to your children, even before they are born. This has a calming effect on the baby, increases healthy bonding between mother and child, and enhances brain development for the baby.

2. Read to your child every day from the day s/he is born, and make sure s/he learns to read before starting pre-school.

3. Limit your child’s time on television, video games and the internet to no more than 2 hours a day. Make sure the programs that s/he watches are high quality and educational. Avoid content that is violent or sexually explicit.

4. Insist that your child do at least one assignment in reading and one assignment in math every day, in addition to the homework s/he gets from school. Homework should be done before watching television, playing games or any other “fun” activity.

5. Make a commitment to work more closely with your child, his/her teacher and principal to make sure s/he is on the right track. This includes making regular visits to the school in between report card pick up. These visits should be geared to keep the lines of communications open between you and the school, and not because there is a discipline problem.

6. Sponsor a book drive and donate books to schools, churches or community based organizations.

7. Start a tutoring program for children and youth, with a goal of increasing reading and math skills.

8. Sponsor a contest and offer a prize for the student who reads the most books within a 3 month period, as evidenced by a book report for each book read.

9. Sponsor a contest to offer prizes for the adult learner who makes the greatest gains in literacy.

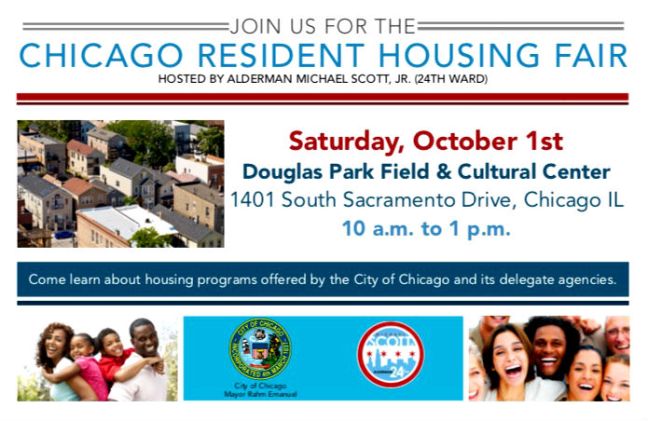

10. Work with your local high school or elementary school to create adult literacy programs geared to increase adult literacy in the community and enhance parents’ ability to help their children with their homework.

______

Valerie F. Leonard is an expert in community and organizational development who works with local organizations to create sustainable communities through technical assistance, specialized workshops and special projects. Visit Valeriefleonard.com for more information.

Valerie F. Leonard is an expert in community and organizational development who works with local organizations to create sustainable communities through technical assistance, specialized workshops and special projects. Visit Valeriefleonard.com for more information.

Valerie F. Leonard is an expert in community and organizational development who works with local organizations to create sustainable communities through technical assistance, specialized workshops and special projects. Visit

Valerie F. Leonard is an expert in community and organizational development who works with local organizations to create sustainable communities through technical assistance, specialized workshops and special projects. Visit